The Total Guide to Submitting an Online Tax Return in Australia in 2024

The Total Guide to Submitting an Online Tax Return in Australia in 2024

Blog Article

Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

Navigating the online tax return procedure in Australia requires a clear understanding of your responsibilities and the sources available to enhance the experience. Crucial records, such as your Tax Documents Number and earnings statements, should be thoroughly prepared. Picking an appropriate online system can substantially influence the effectiveness of your declaring process.

Comprehending Tax Commitments

People should report their revenue precisely, which includes earnings, rental income, and financial investment profits, and pay tax obligations appropriately. Locals must recognize the distinction between taxable and non-taxable revenue to ensure compliance and maximize tax outcomes.

For companies, tax obligation commitments incorporate numerous aspects, including the Goods and Services Tax Obligation (GST), firm tax, and payroll tax obligation. It is vital for businesses to register for an Australian Organization Number (ABN) and, if relevant, GST registration. These responsibilities require thorough record-keeping and timely entries of income tax return.

In addition, taxpayers should recognize with available reductions and offsets that can relieve their tax obligation concern. Seeking guidance from tax specialists can give valuable understandings into enhancing tax placements while making sure conformity with the legislation. In general, an extensive understanding of tax commitments is crucial for reliable financial preparation and to avoid fines connected with non-compliance in Australia.

Crucial Records to Prepare

Additionally, assemble any type of relevant bank declarations that show rate of interest income, in addition to dividend declarations if you hold shares. If you have other resources of income, such as rental properties or freelance job, guarantee you have records of these incomes and any kind of connected costs.

Think about any kind of exclusive health and wellness insurance policy declarations, as these can impact your tax obligations. By collecting these important papers in advancement, you will certainly simplify your on-line tax obligation return process, minimize mistakes, and maximize prospective reimbursements.

Selecting the Right Online Platform

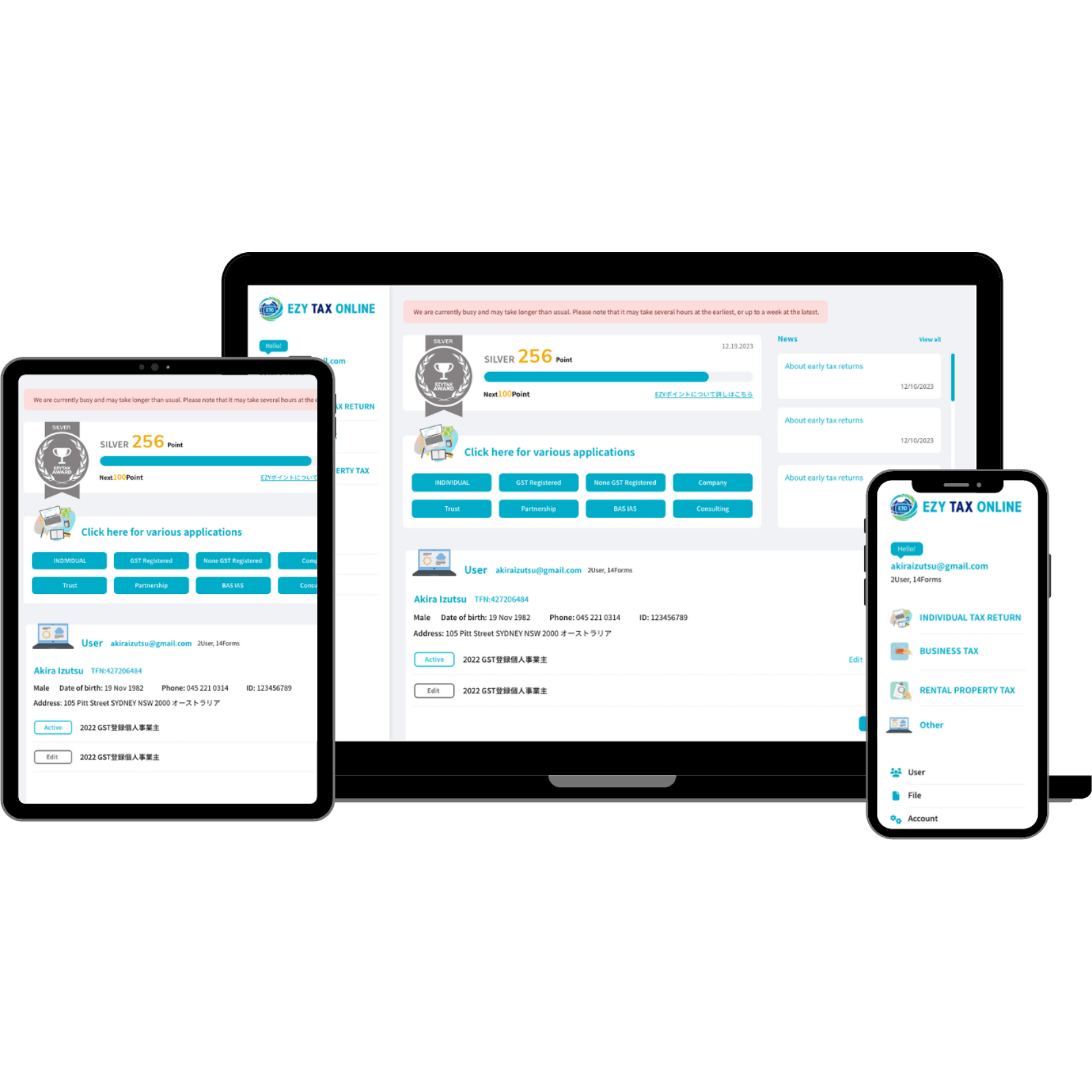

As you prepare to submit your on the internet tax obligation return in Australia, choosing the appropriate system is vital to make certain accuracy and ease of use. A simple, user-friendly design can substantially boost your experience, making it much easier to browse complicated tax obligation forms.

Following, assess the platform's compatibility with your financial scenario. Some solutions provide specifically to individuals with simple income tax return, while others give thorough assistance for much more complex situations, such as self-employment or financial investment income. Look for platforms that use real-time error monitoring and guidance, aiding to decrease errors and making sure compliance with Australian tax obligation legislations.

Another vital aspect to consider is the level of consumer support readily available. Trustworthy platforms must provide accessibility to assistance through conversation, email, or phone, specifically throughout height declaring periods. Additionally, research individual evaluations and ratings to evaluate the general contentment and reliability of the platform.

Tips for a Smooth Filing Refine

Filing your on-line tax obligation return can be a straightforward process if you follow a few vital pointers to make sure performance and accuracy. This article source includes your income statements, invoices for reductions, and any various other relevant documents.

Following, make use of see page the pre-filling function supplied by numerous online systems. This can conserve time and reduce the possibility of errors by immediately populating your return with information from previous years and information given by your company and financial institutions.

Furthermore, verify all entrances for precision. online tax return in Australia. Blunders can cause postponed refunds or issues with the Australian Taxes Workplace (ATO) Make sure that your individual details, earnings figures, and reductions are appropriate

Be conscious of due dates. If you owe tax obligations, filing early not only decreases anxiety but also permits for better preparation. If you have uncertainties or concerns, consult the assistance areas of your chosen platform or seek specialist guidance. By complying with these pointers, you can navigate the on-line income tax return procedure smoothly and with confidence.

Resources for Assistance and Support

Browsing the complexities of on-line tax obligation returns can often be overwhelming, however a selection of sources for support and assistance are conveniently offered to help taxpayers. The Australian Tax Workplace (ATO) is the primary source of info, offering extensive overviews on its site, consisting of Frequently asked questions, training videos, and live chat alternatives for real-time assistance.

Furthermore, the ATO's Recommended Reading phone assistance line is available for those who prefer direct communication. online tax return in Australia. Tax professionals, such as licensed tax obligation agents, can also offer individualized guidance and guarantee conformity with present tax obligation policies

Final Thought

Finally, properly navigating the on-line income tax return procedure in Australia calls for a complete understanding of tax commitments, thorough prep work of essential files, and mindful selection of a proper online platform. Abiding by useful ideas can improve the filing experience, while offered sources use beneficial support. By coming close to the process with diligence and interest to detail, taxpayers can make certain compliance and make best use of possible advantages, ultimately adding to an extra successful and reliable income tax return outcome.

As you prepare to file your on-line tax obligation return in Australia, selecting the ideal platform is crucial to guarantee precision and ease of usage.In conclusion, properly browsing the on the internet tax obligation return process in Australia calls for a detailed understanding of tax responsibilities, thorough preparation of crucial papers, and careful option of a proper online platform.

Report this page